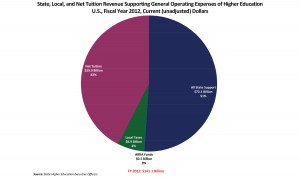

The recent economic downturn has, understandably, increased average tuition costs of virtually all universities. Federal, state, and local economies have all been hit hard and are being forced to make mandatory budget cuts. As a result, student aid has decreased as the money pools dry up. According to the State Higher Education Executive Officers Association (SHEEO), state and local aid per full-time student was $6,483 in 2011- a 3.7 percent decrease from 2010. This trend continued in 2012 with state and local support per decreased an additional 9.0 percent (STATE). With the federal debt increasing every day, federal funding to states and state funding to the universities has been slashed. The state universities are then forced to raise tuition costs in order to maintain the same quality of education.

The recent economic downturn has, understandably, increased average tuition costs of virtually all universities. Federal, state, and local economies have all been hit hard and are being forced to make mandatory budget cuts. As a result, student aid has decreased as the money pools dry up. According to the State Higher Education Executive Officers Association (SHEEO), state and local aid per full-time student was $6,483 in 2011- a 3.7 percent decrease from 2010. This trend continued in 2012 with state and local support per decreased an additional 9.0 percent (STATE). With the federal debt increasing every day, federal funding to states and state funding to the universities has been slashed. The state universities are then forced to raise tuition costs in order to maintain the same quality of education.  To counter the impact of the current recession, Congress passed the American Recovery and Reinvestment Act; which creates a large fund for states to use for operating budget shortfalls in public universities. The thought behind the act was that the money would slow the rise in tuition and lower faculty and staff layoffs during the years or 2009 through 2011. However, federal funds allocated to states for higher education operations through the American Recovery and Reinvestment Act are in jeopardy due to the self-inflicted congressional sequester. Funds had also decreased significantly by 2012 and made up just 0.2 percent ($126 million) of the total state and local support to students that year (STATE). As a result, secondary education has become a serious economic burden on many of America’s students.

To counter the impact of the current recession, Congress passed the American Recovery and Reinvestment Act; which creates a large fund for states to use for operating budget shortfalls in public universities. The thought behind the act was that the money would slow the rise in tuition and lower faculty and staff layoffs during the years or 2009 through 2011. However, federal funds allocated to states for higher education operations through the American Recovery and Reinvestment Act are in jeopardy due to the self-inflicted congressional sequester. Funds had also decreased significantly by 2012 and made up just 0.2 percent ($126 million) of the total state and local support to students that year (STATE). As a result, secondary education has become a serious economic burden on many of America’s students.

With tuition prices rising, many students are graduating with thousands of dollars in debt. Today, outstanding student loans total some $979 billion, with the average student debt exceeding $25,000 (Kantrowitz). When leaving college, students face the daunting task of getting a job in this competitive market. Many recently graduated students are unemployed and struggle to make payments on their loans. According to the Economic Policy Institute, the unemployment rate for college graduates, younger than 25 years old, was 9.3 percent in 2010 (BOSELOVIC). With no spending money, college graduates are slow to put any money into stimulating the economy. A very unfortunate effect of this looming financial burden is that  many young adults simply do not have the funding to attend college. Some of these individuals may possess a very hardworking and dedicated personality and may have potential to achieving many things. College is a place for one to discover the things that he or she are good at and are passionate about. Making college education free would remove these financial burdens from graduates and allow them to spend their money how they see fit.

many young adults simply do not have the funding to attend college. Some of these individuals may possess a very hardworking and dedicated personality and may have potential to achieving many things. College is a place for one to discover the things that he or she are good at and are passionate about. Making college education free would remove these financial burdens from graduates and allow them to spend their money how they see fit.

Together We Can