Blog 3: Creative Financing Strategies

Navigating The Current Financing Environment

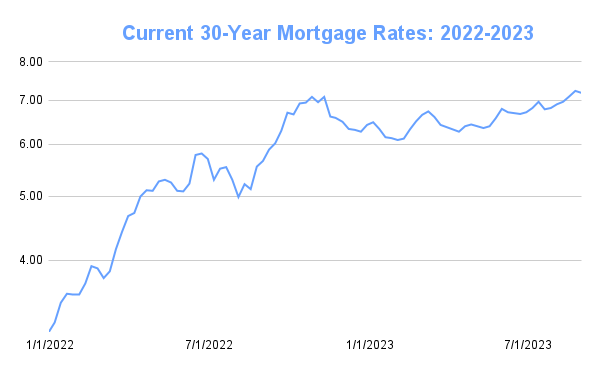

As the commercial real estate industry and broader economy grapples with rising interest rates and construction costs, once feasible investments are no longer manageable due to the increase in debt service cost. Over the next decade, It will be necessary for lenders, developers, and buyers to become innovative in how they finance and view their acquisitions and future projects.

I believe that over the next few years, the assumable commercial mortgage will emerge as an attractive asset to buyers, and will allow sellers the opportunity to close on properties in a quicker fashion. With interest rates nearing eight percent, these outstanding mortgages, with significantly lower interest rates, will be highly attractive to buyers.

An assumable commercial mortgage allows the new buyer to take over the seller’s existing mortgage under specific terms that are spelled out. For the context of this post, the assumable mortgage provides flexibility on the buyer side of the deal by helping to mitigate the capital risks of the current lending environment. Depending on the specific mortgage in question, a buyer may have the chance to assume a 3% mortgage and pay to cover the seller’s equity, whereas a bank today is going to offer that same buyer somewhere between 7-9% on a new commercial mortgage.

As rates have risen, refinancing is becoming a harder and harder task for lenders. A mentor of mine who is an associate with JLL’s Capital Markets team said to me recently, “Refinancing office is not an option right now… The bank just won’t do it”. For principals who own the assets and may not have cash on hand to meet debt service, this causes a major issue as they were always able to refinance with ease over the last few decades. Furthermore, if a property is reassesed during the process of a new sale, the incoming owner may not be able to afford the reassesed value at the current lending rates.

As demonstrated by the variety of scenarios above, rising rates have caused major turmoil in Commercial Real Estate investments. Moving forward, all parties involved must realize this is no longer 2019, and it is time to be smart, serious, and extremely analytical when it comes to financing a property in 2023. Creativity will play a role, and my personal hypothesis is that assumable commercial mortgages will be a very hot commodity when comparing properties.

Graph Depicting The Rise In Mortagage Interest Rates Over The Last Year

Leave a Reply