Over the past twelve months, conversations surrounding national debt have been introduced and then reintroduced after President Biden took office. While it can be said that national debt is money that we, as a country, may potentially owe, there are many schools of thought that either support it or negate it.

In one school of thought, it is assumed that having national debt is logical as long as the growth rate of deficit spending is less than the rate of inflation. In other words, if a country’s spending below the rate at which the value of money depreciates, the government can potentially print enough money to pay off its debt.

In another school of thought, it is considered that deficit spending is good as long as it is used to create long-term assets. When assets like roadways, railways, etc. become usable, they provide a capital rate of return to the economy. Economists believe that as long as the said rate of return is greater than the rate of lending, it makes sense for a government to spend more than its revenues.

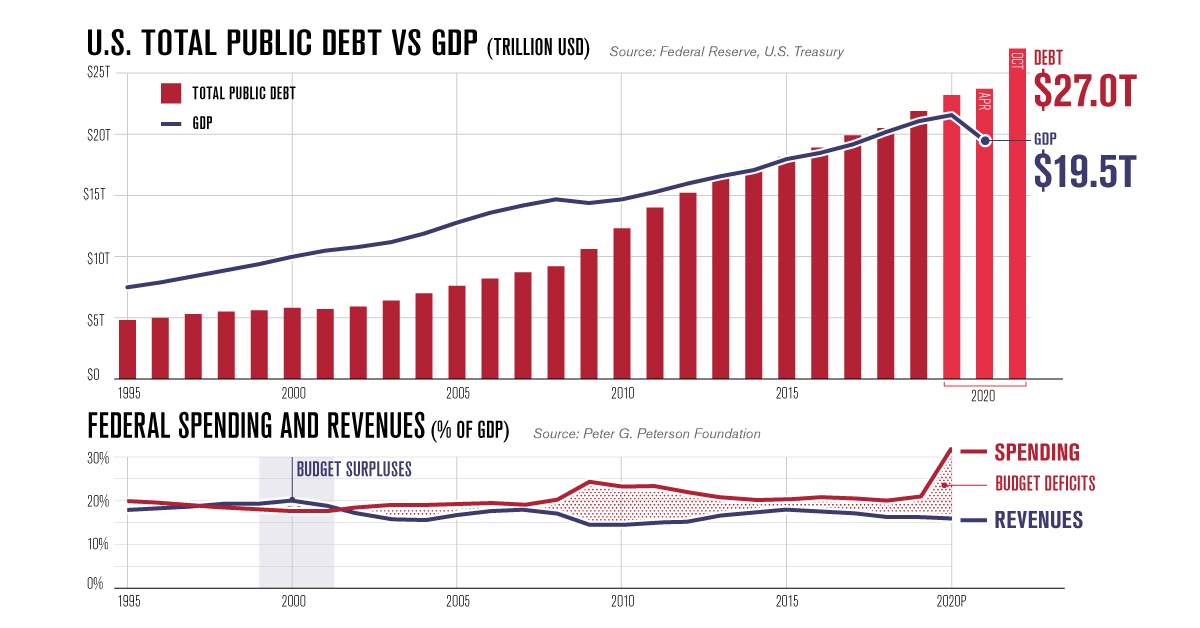

Parallelly, another school of thought that has lost its popularity in economic circles dwells in the comparison between the size of the national debt and the size of the economy. The theory was debunked when the US’s national debt crossed its level of GDP.

Charting America’s Debt: $27 Trillion and Counting

While economists are split between the level of deficit spending, they agree that as long as money is used for the creation of capital stock, the economy will continue to expand in the long run.