In one of my blog posts from many weeks ago, I discussed the issue of price gouging prohibitions in areas of disaster. I analyzed and discussed how gouging is actually generally not a detrimental abuse by sellers and firms of their buyers’ situations, but rather is simply the market responding appropriately to a shortage in order to most efficiently allocate resources to those who need them the most. I discussed how allowing prices to react to market forces ensures that the existing goods in a disaster area are allocated most efficiently, helping to ease the burden of the shortage that exists. I also discussed how allowing arbitrage to take place with private sellers bringing goods into the area at a marked up price increases local supply, and thus also helps to reduce the detrimental effects of shortage in the area. If you are interested in this topic and plan to read this post, I highly recommend you revisit my previous blog post, which provides a fairly concise summary of the issue at hand. If you have more time, I recommend you read this scholarly article titled “Planning Disaster” written by Micheal Brewer, which provides an excellent, comprehensive analysis on price gouging and the laws that prevent it, as well as the unique solution that I will discuss in this blog post. This post will be explaining the merits of a system in which the federal government incentivizes state governments to repeal harmful gouging prohibitions in exchange for federal disaster relief aid. Additionally, these federal resources would be allocated to the areas in which the market price for said goods is highest, indicating areas of most need and allowing for the more efficient distribution of resources during disasters.

First let me reiterate, this post will only be best understood if you at a minimum read my previous blog post. Additionally, I cannot explain this solution in this post as well as the original author can; if you are still skeptical, I highly recommend you read through Micheal Brewer’s “Planning Disaster” Article I referenced earlier. That being said, I will get into discussing this solution.

At the core of this proposal is the idea that price gouging bans passed at the state level are overall detrimental during times of disaster and only serve to exacerbate the shortages that are caused by natural disasters. However, this is only well understood among the economic community, as most politicians and their constituents find price gouging bans to be appropriate. Even if state representatives were enlightened as to the harmful nature of these laws, they would be hard pressed to do much about it, as they would likely lose support of many constituents if they voiced support for such reform. Brewer’s plan seeks to remedy this by providing for a multi functioning system of incentives to be introduced by the federal government that would make it much easier and desirable for state governments to repeal such laws. The federal government, in a move resembling a sort of fiscal federalism, would pass legislation that would prioritize relief goods to areas in which the market price for said goods is highest. This would cause state governments to have reason to repeal the shortage worsening price ceilings that were in place, since they would impede their ability to receive federal aid. Importantly this would allow state governments to act with a justification for their actions, so as not to anger their constituents. Overall, this would contribute to a reduction in shortages during times of disaster, primarily due to the ability for resources to be efficiently allocated by the market, as well as for outside sellers to bring more goods into the areas, increasing overall supply and naturally reducing prices without sacrificing efficiency.

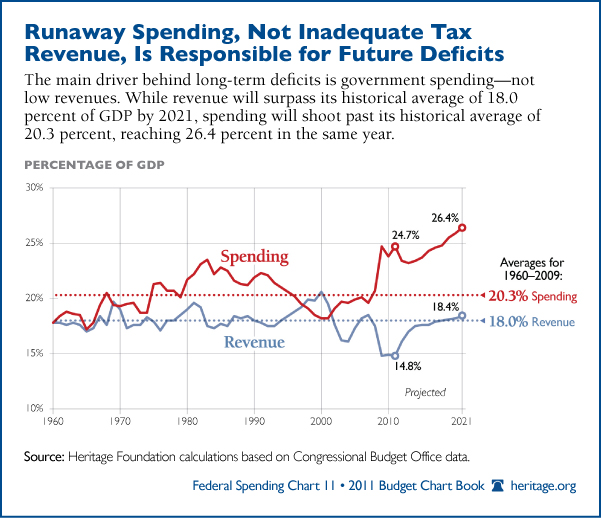

The other major advantage of this incentive based approach, is that it will provide a much more efficient mechanism for distributing federal emergency aid to places that need it the most. Often times during such disasters as hurricanes and tropical storms, vast areas, or even several areas, are devastated with destruction and shortage. Figuring out how to best distribute the federal aid that is available is no easy task and requires a great deal of time and effort, slowing the process of actually getting the aid to those who need it. Under this mechanism, goods would be allocated to areas in which the prices for the goods are highest, indicating the areas of greatest shortage. This would in theory be incredibly more fast and efficient than the current process of allocation. Another beneficial consequence of this plan would be that it would naturally drive down prices in disaster areas without creating shortage. Competition from the government resources that will have been added to the market will force local prices down as a response to an increase in supply caused by an additional supplier being added to the local market (the federal government. This would mean that not only would the areas that most need goods get them, but the market price for those goods in that area would be naturally reduced, without worsening shortages in the way that price ceilings do.

Overall this method offers an insightful and logically structured solution to the issue of price gouging laws. Unfortunately I can see very little likelihood that this would ever even be proposed before Congress. This is due largely to the public’s general condemnation of “price gouging” despite the economic community generally voicing contradictory opinions. I believe that because of this, better economic education is essential to the betterment of our nation, so that despite emotional tendencies of the public, economically logical policies may be enacted by our government. An important thing to realize is that theories like this aren’t cold and inhuman, they aren’t just numbers, rather they actually represent what would truly provide the best situation for the greatest number of people, a goal that I find to be worthy of pursuing.