Deciding whether to classify a worker as an employee or an independent contractor is one of most important decisions for a business. There are many ramifications for wrongly classifying a person, mainly regarding taxes owed to the IRS and money owed to the worker. When analyzing this important decision, the National Labor Relations Board (the “Board”), and courts in the United States, have applied the common-law test that uses several factors to help determine whether a person is an employee or an independent contractor. Although the test has been around for a long time, the Board recently returned to clarify the role of “entrepreneurial opportunity for economic gain” in the case SuperShuttle DFW, Inc.

and money owed to the worker. When analyzing this important decision, the National Labor Relations Board (the “Board”), and courts in the United States, have applied the common-law test that uses several factors to help determine whether a person is an employee or an independent contractor. Although the test has been around for a long time, the Board recently returned to clarify the role of “entrepreneurial opportunity for economic gain” in the case SuperShuttle DFW, Inc.

The Facts of the Case

The case involved shuttle-van-driver franchisees of SuperShuttle. SuperShuttle drivers sign a Unit Franchise Agreement (“UFA”) that expressly characterizes them as non-employee franchisees who operate independent businesses. The UFA also states, among other things, the following:

- Franchisees are required to supply their own shuttle vans;

- Franchisees are required to pay SuperShuttle an initial franchise fee and a flat weekly fee for the right to utilize the SuperShuttle brand and its Nextel dispatch and reservation device;

- Franchisees are not required to work a set schedule or number of hours or days per week (they work as much as they choose, whenever they choose);

- Franchisees do not incur any negative consequences for passing on a trip, unless they accept a trip and then do not complete it;

- Franchisees are entitled to the money they earn for completing the assignments that they select.

Overruling FedEx Home Delivery

Entrepreneurial opportunity for economic gain, historically, had not been a factor included as one of the factors in the independent contractor test. This aspect had always been seen as an end item the courts and the Board would use to interpret the factors of the test. The Board would consider how the evidence in a particular case, viewed in light of all the factors, revealed whether the workers at issue did or did not possess entrepreneurial opportunity for economic gain. The Board departed from this standard, however, in FedEx, which was decided prior to SuperShuttle. In that case, the Board held that entrepreneurial opportunity represented merely one aspect of one of the factors of the test called “rendering services as part of an independent business.” The Board decided to revisit this standard in SuperShuttle.

The Board departed from this standard, however, in FedEx, which was decided prior to SuperShuttle. In that case, the Board held that entrepreneurial opportunity represented merely one aspect of one of the factors of the test called “rendering services as part of an independent business.” The Board decided to revisit this standard in SuperShuttle.

The Board decided in SuperShuttlethat the FedExdecision had impermissibly altered the long standing factor test by creating a new factor and then making entrepreneurship opportunity one aspect of that factor. The Board decided to overrule its previous decision and return to the traditional test applied prior to FedEx.

The Clarified Standard

The Board decided to return to the traditional view of looking at how the evidence in a particular case affects the factors of the test, and from there, deciding whether or not the evidence shows that the worker had an entrepreneurial opportunity. The Board held that entrepreneurial opportunity is a principle by which to evaluate the overall significance of the factors. The Board compared entrepreneurial opportunity with the principle of employer control. The Board mentioned that factors that support a worker’s entrepreneurial opportunity will indicate independent contractor status, while factors that support employer control will indicate employee status.

The Board also mentioned that the independent contractor analysis is a qualitative, not quantitative analysis. A court cannot simply count the factors and see how many of the factors favor independent contractor and how many favor employee. The Board must evaluate each factor based on the circumstances of that case. If the evaluation shows significant opportunity for economic gain and significant risk of loss, the Board is likely to find that the worker is an independent contractor.

Conclusion

Applying its clarified standard, the Board concluded that the franchisees of SuperShuttleare not statutory employees under the National Labor Relations Act (the “Act”), but rather independent contractors excluded from the Act’s coverage.

The Board found that the franchisees had significant entrepreneurial opportunity for economic gain because (1) they were required to own or lease their work vans, (2) all the money they made was theirs, (3) they decided when and how much they worked with no control from SuperShuttle, (4) SuperShuttle did not supervise them, and (5) the parties’ understanding that the franchisees were independent contractors because it was stated in the UFA.

This decision should give employers some clarity in applying the factors in the common-law test to determine the correct classification of workers.

Reference:

SuperShuttle DFW, Inc. and Amalgamated Transit Union Local 1338. Case 16-RC-010963

https://esub.com/independent-contracto/

https://www.floattanksolutions.com/employees-vs-independent-contractors-better-offering-additional-service/

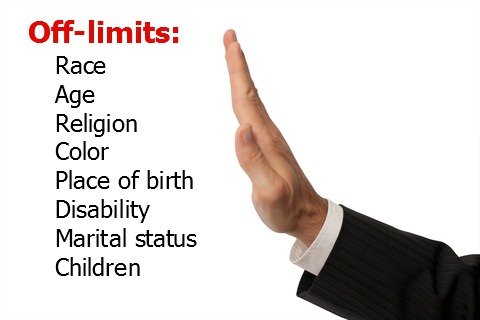

These are questions that solicit information involving the following: age; race, ethnicity, or color; gender or sex; country of national origin or birth place; religion; disability; marital or family status; or pregnancy. Knowing this type of information is likely to make a company liable in a discrimination lawsuit. Employers need to avoid asking those types of questions when conducting an interview to protect themselves against a lawsuit. Employers who are aware of the law avoid asking these questions to make sure they are not soliciting this information. However, what happens when the interviewee gives that sort of information without being asked? What happens when the employer stays away from all those questions, but finds out about the information anyway?

These are questions that solicit information involving the following: age; race, ethnicity, or color; gender or sex; country of national origin or birth place; religion; disability; marital or family status; or pregnancy. Knowing this type of information is likely to make a company liable in a discrimination lawsuit. Employers need to avoid asking those types of questions when conducting an interview to protect themselves against a lawsuit. Employers who are aware of the law avoid asking these questions to make sure they are not soliciting this information. However, what happens when the interviewee gives that sort of information without being asked? What happens when the employer stays away from all those questions, but finds out about the information anyway?