So, you’ve found the idea that you wish to build your business around. What’s the next step? There are a variety of answers to that question depending on who you ask, but chiefly among them should be solving the riddle of, “How am I going to profit off of this idea?” Traditionally, when people wanted to buy a product, they all went through the same general routine: 1) figure out what they want to buy 2) find where the product was sold 3) go to where the product was sold 4) buy the product 5) rinse and repeat. To facilitate this transaction of products, business owners would open up brick and mortar store locations locally to make this consumer cycle accessible to potential customers. And then, the internet.

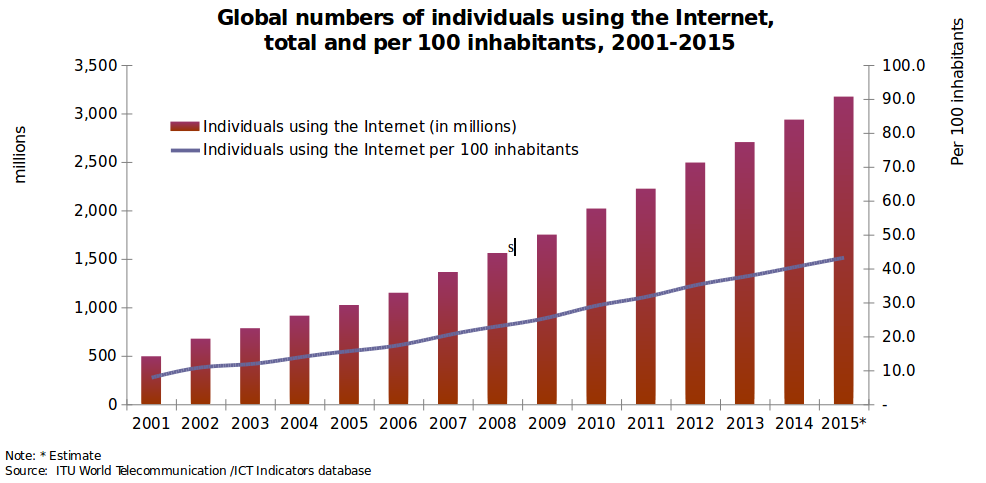

With the foundation-shattering internet revolution over the last 20 years, business owners have had to fundamentally rethink this customer-facing, physical storefront business model. This revolution has been so game-changing that it has essentially required business owners to have at least some kind of online shop if not operate entirely online. How transformative has selling goods online become? Roughly 80% of the world’s internet users have bought goods and services online. When people first began Amazon shopping and eBay bidding in 1995, the entire online shopping market was valued at just $131 million and the likes of Paypal had not even been invented yet. In 2015 when almost all major retailers are now online and customers are increasingly shopping on their phones with multiple payment options, e-commerce is valued at a staggering $1.55 trillion![1]

As the method of selling goods to consumers has evolved, so have the rules and regulations facilitating such an exchange. In a recent Supreme Court ruling[3], the Court tackled the question of whether states should expect retailers with no physical state presence to collect a tax that residents of those states are obligated to pay. The court held that the previous rule requiring a physical presence to collect sales tax was no longer valid. The court referred to the proper relationship to collect sales tax as a substantial nexus. This language leaves room for interpretation, but definitively makes it known that the standard for collecting state sales taxes has changed.[4]

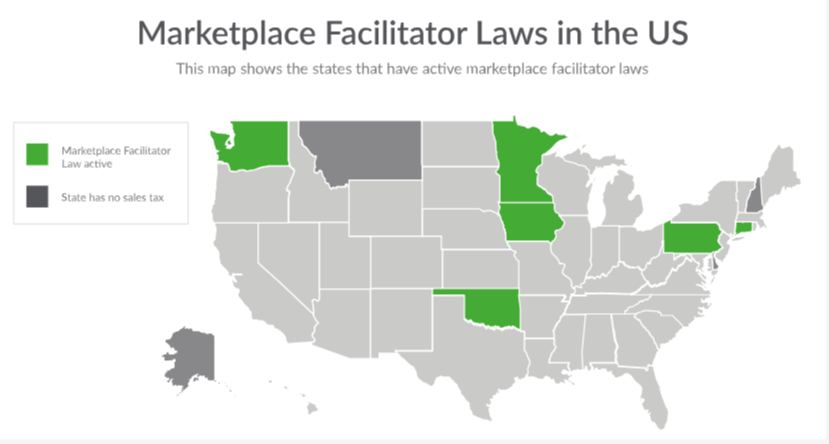

Becoming an online retailer, however, is not the only way to establish an internet sales presence. One of the ways small business owners and entrepreneurs can break into the online storefront market is by utilizing the services of a marketplace facilitator (e.g. Etsy, or eBay). As defined by the Pennsylvania Department of Revenue, a marketplace facilitator is one who facilitates the sale of goods and services by: 1) Advertising goods and services for sale in a physical or electronic forum; 2) Collecting payment from the purchaser on behalf of the seller either directly or indirectly; and 3) Remitting payment back to the seller.[5] By choosing the services of a marketplace facilitator, budding small businesses can alleviate some of the daunting legal considerations mentioned above.

In addition to the recent Supreme Court ruling, potential online platforms dedicated to facilitating transactions for aspiring business owners, including Etsy and eBay, have revamped their policies regarding sales tax as well. Based on applicable tax laws, eBay will calculate, collect, and remit sales tax on behalf of sellers for items shipped to customers. The collection process will apply to all sales, whether the seller is located in or outside of the United States. As of 2019, eBay has begun to collect sales tax in four states. eBay has also announced plans to scale this practice out to multiple other states, including Pennsylvania around July of 2019. The good news for business owners is that once eBay starts to collect tax, no action is required on their part, and there will be no charges or fees for eBay automatically calculating, collecting and remitting sales tax.[6]

The rules and regulations governing the online sale of goods vary from state to state as well as from good to good. Before diving head first into deciding whether to open up a candle store at the mall or to create a website to sell screen-printed t-shirts, make sure to check any and all relevant federal, state, and local laws.

[1] https://www.altushost.com/the-history-of-e-commerce-online-shopping-evolution-and-buyers-behaviour/

[2] https://www.bigcommerce.com/blog/online-business-laws/

[3] South Dakota v. Wayfair, Inc., 138 S.Ct. 2080 (2018).

[4] https://www.ecommercebytes.com/C/abblog/blog.pl?/pl/2018/6/1529591988.html

[5] https://www.revenue.pa.gov/GeneralTaxInformation/Tax%20Types%20and%20Information/SUT/MarketPlaceSales/Pages/Marketplace-Facilitators.aspx

[6] https://www.ecommercebytes.com/2019/01/04/ebay-starts-collecting-sales-tax-with-more-states-to-come/

The internet chart tells a powerful story! I found the article to be very enlightening, I never knew other states besides PA were collecting online sales tax. I am curious how fast other states will follow suit. Great article Idan!

Idan,

Great post. There’s definitely been a shift from physically locations toward more online sales. Businesses really need to be aware of when they will need to remit taxes to other states to avoid surprise tax bills. Just as important is being aware of the exceptions too.

Idan,

Fantastic post. Very well written. This post is so practical — something that all entrepreneurs should read. For companies to compete in the modern marketplace, it is necessary to have an online presence. And with any online transaction, certain tax ramifications exist. You did a great job of summing those potential ramifications up.

– Cameron