Introduction

Welcome back, readers. It has been a while. This week, we will be discussing public perception of Biden’s American Jobs Plan. I will dissect which components are widely supported and which ones are more controversial. In addition, the alternative infrastructure plan proposed by a group of Republican Senators will be explored. Let’s get started.

Biden’s Plan

According to a Fact Sheet from the White House, Biden’s plan consists of six main components:

- Fix highways, rebuild bridges, upgrade ports, airports and transit systems: 20,000 miles of roads, highways, and streets to be modernized. 10 large bridges and 10,000 small bridges to be repaired. Replacement and renewal of public transportation including buses, rail cars, train stations, airports, and rail.

- Deliver clean drinking water, a renewed electric grid, and high-speed broadband to all Americans: Elimination of all lead pipes. Expand high-speed broadband access to 35% of rural America.

- Build, preserve, and retrofit more than two million homes and commercial buildings, modernize our nation’s schools and child care facilities, and upgrade veterans’ hospitals and federal buildings: Jobs created for building and renovating energy efficient housing, commercial buildings, schools, and child care facilities. Improvement of federal facilities for veterans.

- Solidify the infrastructure of our care economy by creating jobs and raising wages and benefits for essential home care workers: Creation of new jobs for care providers by expanding home and community-based health care services.

- Revitalize manufacturing, secure U.S. supply chains, invest in R&D, and train Americans for the jobs of the future: Investment in American manufacturing and innovation while providing good-paying jobs.

Biden’s plan will ultimately cost over $2 trillion and will be paid for mainly through raising the corporate tax rate from 21% to 28%. The payback period of the plan is roughly 15 years.

Republicans’ Compromise

Republican senators have criticized the size and cost of Biden’s plan. In addition, they believe that it includes a lot of policy items beyond the scope of traditional infrastructure.

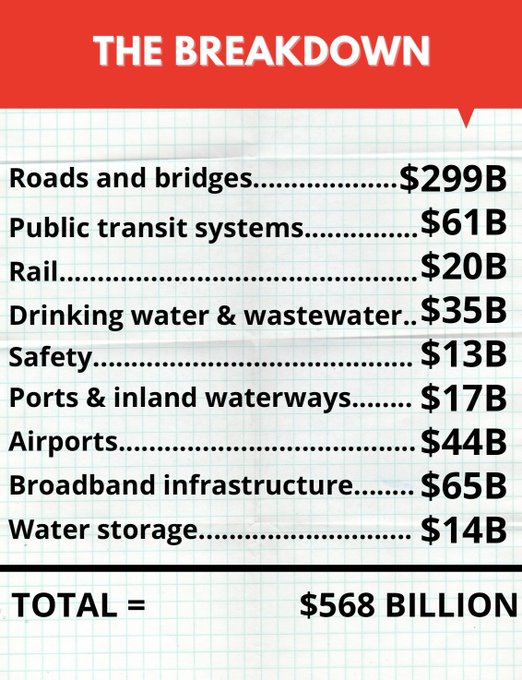

Shelley Moore Capito (R-WV) has proposed a much smaller package:

This package would be funded mainly through reallocating unutilized funds that have been approved by Congress. In addition, it would narrow the definition of infrastructure to only include items related to roads and bridges, public transit systems, rail, water and wastewater, ports and inland waterways, airports, broadband, water storage, and safety.

Moderate Democrats’ Dissent

Two prominent moderate Democrat senators do not completely back Biden’s plan either. Joe Manchin (D-WV) is open to spending as much as $4 trillion as long as the infrastructure package can be funded by tax increases. However, Manchin is only willing to raise the corporate tax threshold to 25% rather than 28%.

In addition, Biden ally Chris Coons (D-DE) prefers to split the current package into smaller pieces of legislation. The bipartisan components would be worth around $800 billion and would be easily passed by the Senate. The rest, worth around $1.2 trillion, would be passed via the budget reconciliation process on a split-party, simple-majority basis.

Public Opinion

In terms of the public’s view, there seems to be a general consensus of support for Biden’s plan. Across party line’s, there is well above majority support for the following components of the American Jobs Plan: 1) modernizing highways, roads, and streets, 2) improving caregiving for old and disabled, 3) replacing lead waterpipes and service lines, 4) building and improving public schools, and 5) modernizing veterans’ hospitals. The only strong disagreement seems to be over boosting medical manufacturing and raising corporate tax rates to fund the infrastructure package.

Analysis and Conclusion

The American Jobs Plan seems to be the case of President Biden proposing broadly popular bipartisan initiatives. So it makes sense that there is widespread support across party for the plan.

Where most of the disagreement seems to lie is in funding the plan. Biden and Senate Democrats want to raise corporate taxes to varying degrees while Senate Republicans want to avoid waste by reallocating already approved funds. This Democrat vs. Republican disagreement also shows up in the general populous as 85% of Democrats approve of raising the current corporate tax rate while the same can be said for only 42% of Republicans.

The cost of the package also seems to be another major divide in the Senate. However, the public seems to support all the main components of the plan, so that assumes they are okay with the cost.

My prediction is that Senator Coons will be right in that the popular components of the package will pass on bipartisan terms while the rest will be done via the reconciliation process. There seems to be a major disconnect between popular spending bills and the intense partisan gridlock of the Senate. Republican senators do not seem to be listening to their constituent’s overwhelming support of Biden’s plan (besides the opposition of the corporate tax increase).

So who is influencing who in this case? It seems like Biden’s policies gain broad support amongst voters across political affiliations, so this is the classic case of the President using the “bully pulpit” to their advantage.