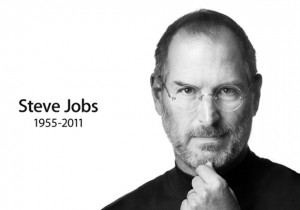

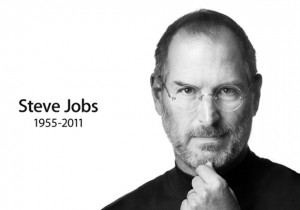

This week marked the passing of a man who changed the face of the world we live in. While I’m not an Apple product addict (like many people I know), I cannot help but appreciate the magic that was Steve Jobs. I think back in amusement to my first personal computer. In 1989 I was using a heavy, clunky, DOS based IBM knockoff with no hard drive that booted up from a designated start-up 5 ¼ inch floppy disk. Now I glance down at the touch-screen Android smart phone on my desk and know it is a gazillion times more powerful and useful than that first computer I was so grateful to have….and I can carry it in the palm of my hand. I know that despite the fact that I’m not using Apple products, I would not have the technology I am accustomed to without the contributions of Steve Jobs. He had an amazing ability not only to create the products the people wanted and needed, but to create the products we didn’t even realize we needed. (Think iPod and iPad. Who wished for them before Steve Jobs presented the idea to us? But now that they exist, how can we resist?)

So in honor of the great Steve Jobs, it seemed appropriate to bring his words into this week’s post. While he certainly was no thinking specifically about law school finance in speaking these lines, they are certainly applicable:

“That’s been one of my mantras—focus and simplicity. Simple can be harder than complex. You have to work hard to get your thinking clean to make it simple. But it’s worth it in the end because once you get there, you can move mountains.”—Business Week, 1998. Keep the simple stuff in focus. Pay the bills on time. Spend less than you have. It’s the mundane that helps to get you to the point of success. And it’s the mundane that is hardest to want to achieve.

“My model for business is The Beatles. They were four guys who kept each other’s kind of negative tendencies in check. They balanced each other and the total was greater than the sum of the parts. That’s how I see business: great things in business are never done by one person, they’re done by a team of people.”—Interview with 60 Minutes, 2003. You can’t do everything single- handedly. Acknowledge the things you could use some help with and employ the assistance of someone who has strength in that area. This includes organizational skills and money management. Don’t be afraid to ask for help.

“Quality is more important than quantity. One home run is much better than two doubles.”– Business Week, 2005. This absolutely applies to retail purchases. Sometimes the best thing is not the cheapest thing. But sometimes quality is worth the extra money. I rarely spend much money on a clothing purchase. But when I do, it is invariably for something that I will wear very often. My favorite black slacks cost me about $60. That is a lot for me to spend on one piece of clothing. But I have worn them once a week (or more) consistently for at least five years. Right now that’s less than 25 cents per wear, and because they are great quality that trend will continue for years to come. I don’t need several pairs of black slacks. I need one great quality pair that I love.

“…You can’t connect the dots looking forward; you can only connect them looking backwards. So you have to trust that the dots will somehow connect in your future. You have to trust in something—your gut, destiny, life, karma, whatever. This approach has never let me down, and it has made all the difference in my life.”—Stanford University commencement address, June, 2005. Embarking on your legal education was a calculated risk. You don’t know exactly where it will lead you. But something told you this was what you want to do…and that it will lead you to things that make a difference. It may not work out exactly the way you originally hoped. But it will work out in exactly the way it is supposed to.

“Your work is going to fill a large part of your life, and the only way to be truly satisfied is to do what you believe is great work. And the only way to do great work is to love what you do. If you haven’t found it yet, keep looking. Don’t settle. As with all matters of the heart, you’ll know when you find it. And, like any great relationship, it just gets better and better as the years roll on. So keep looking until you find it. Don’t settle.”—Stanford University commencement address, June, 2005. You will pursue with passion the things that you love… in work, in love, and in finance. Something you love that makes you amazingly happy is many times more valuable than something that just seems like a good deal. Try to be sure of what you want before you commit. And if you can’t be sure in advance, don’t be afraid to admit that a decision may not have been the right one and take action to move a different direction.

When we think of Steve Jobs, we think of his many successes. We think MacIntosh computers, iPod, iTunes, iPad, and iPhone. But what is so striking to me about Jobs is his failures and how he learned from them and bounced back. The Apple I and Apple II computers sold only hundreds of units. The Lisa computer was such a huge failure that Apple fired Jobs. What did he do? He created a company called NeXT and a little thing called Pixar. NeXT was eventually purchased by Apple (who begged Jobs to come back to the helm) and Pixar changed the way animated movies are created. Failure could not stop his genius. I remember many years ago asking my mother why it seemed like I fail at things so much more often than my brother and sister. Without missing a beat she said, “Because you take more risks.” Steve Jobs took a lot of risks. And he had a lot of failures. But from great risks come the most amazing successes.

Thanks for changing our world for the better, Steve Jobs!