The unexpected advantages of offering retirement plans in the era of The Great Resignation

By Taylor Haberle

The Great Resignation

Recruiting and retaining talent became a sudden challenge for many employers in 2021. A record 38 million Americans voluntarily left jobs in 2021. There are an unprecedented 10.6 million open job listings. The labor force participation rate has never recovered from pre-pandemic highs and the unemployment rate sits below 4%. This historic shift in the labor market has forced employers to get creative. Many large employers have instituted sign-on bonuses, retention pay, and permanent work-from-home policies. Smaller employers have struggled to keep up. These recruitment strategies are significant investments and labor costs have already risen at the fastest rate since 2001. Entrepreneurs should consider alternate incentives to recruit and retain talent, such as implementing defined contribution retirement plans.

Defined contribution retirement plans, such as 401(k)s, are an excellent way to incentivize new and existing talent. They allow a lot of flexibility and provide some excellent tax benefits. Employees are looking for them, too. A survey found that 67% of employees said a good 401(k) plan was important or very important when evaluating a job offer. Another survey found that nearly 80% of workers would prefer new or additional benefits to a pay raise. Fidelity Investments found that only 13% of workers would accept a job with no employer match with their 401(k).

Decisions, Decisions

Entrepreneurs with less than a hundred employees have three primary options when choosing a retirement plan. Each has its own advantages.

401(k)’s are the most popular defined contribution retirement plans for a reason. Workers make pre-tax contributions and employers may choose to match a certain percentage. Both employers and employees enjoy a lot of tax benefits. Employers can delay the vesting of employer contributions to incentivize employee retention. They can be costly to sponsor and administer, though. Smaller employers can avoid some of these administrative headaches through a SIMPLE 401(k) program. There are also fewer decisions to be made. Employers can match up to 3% of their worker’s wages or elect to make a flat mandatory 2% contribution. Employers should know that they are required to make contributions and that all contributions vest immediately.

SIMPLE IRAs operate similarly and are another popular choice for small employers. Workers also enjoy tax-deferred status with SIMPLE IRAs. Employees also enjoy a lot of flexibility in investments. Employers typically enjoy fewer administrative costs. Employers are still required to make contributions; however, they can temporarily reduce their contributions during a bad year. Employer contributions are limited and vest immediately like a SIMPLE 401(k).

SEPs, or Simplified Employee Pensions, operate differently. The most important contrast is that only employers contribute to SEPs. Employers can make much larger contributions- up to 25% of the worker’s wages. Employers are also not required to make a mandatory contribution. This makes them an excellent choice if you’re in a volatile industry. They also feature low administrative costs.

Tax Advantages

Retirement plans are the most cost-effective way to increase an employee’s total compensation. Employer contributions to eligible retirement plans are not subject to FICA payroll taxes, saving the employer around 7.7%. This might not sound like much at first, but it can really add up over time. Employees also save on their tax bills by deferring income until retirement. These mutual tax advantages make retirement plans an excellent vehicle to increase total compensation.

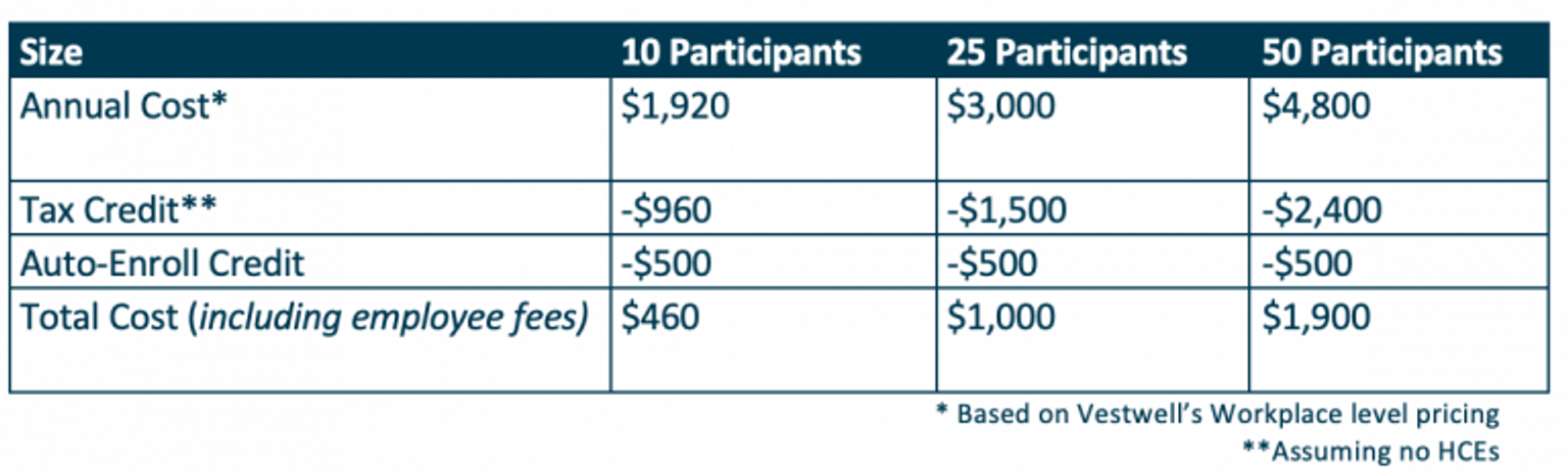

The benefits don’t stop there. Congress passed the SECURE Act in 2019, which overhauled many popular retirement plans. The Act included some excellent tax incentives for small employers to start some of the aforementioned retirement plans. Eligible small employers can claim a tax credit of up to $5,000 a year for starting up and administering a qualified retirement plan. In short, the credit covers 50% of the costs related to the retirement plan. Employers also enjoy a $500 annual credit when they set up automatic enrollment for new employees. As seen below, a qualified employer can offset a lot of start-up and administrative expenses through these tax credits.

Action Steps

Starting a retirement plan doesn’t need to be expensive or time-consuming. Employers should expect to initially spend between $500 and $2000 to create a traditional 401(k) plan. An employer will also need to hire a third-party administrator to maintain the plan. Employers generally spend between $20 and $60 a year for each employee enrolled. SIMPLE 401(k)s, SIMPLE IRAs, and SEPs should be on the lower end of that spectrum. Employers should also look at retirement offerings from financial technology (“fintech”) companies. They allow employees to completely customize a plan with low administration costs. Remember, you can receive a tax credit for half of these expenditures.

Employers should also inform and educate employees about their new retirement plan. Retirement plans are complicated instruments and can be overwhelming for many employees. You should also promote the benefit because some retirement plans have a minimum participation or benefit rate. You should talk to your plan administrator about these rules when setting up the plan.

Employers should also talk to their plan administrator about eligibility requirements and vesting schedules. Employers can usually exclude an employee from a retirement plan until they reach 1-2 years of service. Employers can also configure the plan so that their matching contributions don’t fully vest for 2-7 years. Many employers believe that vesting schedules help retain talent because employees are incentivized to stay in their current position.

Finally, employers should promote their retirement benefits in job listings. As we previously discussed, many workers prioritize retirement benefits when searching for a job. A qualified retirement plan can be an excellent tool in recruiting new talent.

Sources

https://www.businessinsider.com/how-many-why-workers-quit-jobs-this-year-great-resignation-2021-12

https://www.bls.gov/news.release/jolts.nr0.htm

https://www.bls.gov/charts/employment-situation/civilian-labor-force-participation-rate.htm

https://fred.stlouisfed.org/series/UNRATE

https://www.atlantafed.org/chcs/wage-growth-tracker

https://www.betterment.com/hubfs/PDFs/b4b/reports/401k-employer-survey-report.pdf

https://b2b-assets.glassdoor.com/benefits-employees-want-most-2017.pdf

https://www.shrm.org/resourcesandtools/hr-topics/benefits/pages/pay-or-401k-match.aspx

https://www.irs.gov/retirement-plans/choosing-a-retirement-plan-simple-401k-plan

https://www.irs.gov/retirement-plans/plan-sponsor/simple-ira-plan

https://www.irs.gov/retirement-plans/plan-sponsor/simplified-employee-pension-plan-sep

http://cdn.statcdn.com/Infographic/images/normal/26186.jpeg

https://cdn.sanity.io/images/xeu2ch52/production/8acf9d6474ea43466846ece0932e46c2966b5a64-768×232.png?w=1600

Dear Taylor,

Overall I really enjoyed your post. It is an interesting look into what small businesses can do to offset the fluctuating amount of employees available at this point in time. I think your suggestion into buffing up an employees retirement plan it is an interesting solution that many in this field have overlooked. As a previously unaware 3L, I was told during my job search that retirement plans could be very beneficial to look into when starting out at a firm because they could be easy backdoors into getting more money out of your contract than most people realize is available.

The only feedback that I can really give is I’d love to see would be a picture or two on your blog post. While both charts posted highlight points you are making, I feel like a picture would really tie everything together well.

It’ll be interesting to see down the line if your suggestion will be actually taken and followed by small businesses and companies across the nation as they try to hire people. After reading your post, I’d love to see a study five years down the line to see if this solution was followed by different businesses and panned out in the way that you hypothesized.

Best,

Danny

Taylor, this was an interesting read. Individuals entering the job market and even those looking for new opportunities often need extra incentives to leave the security of their current employer to go to another. What better incentive than a solid retirement plan. This blog is especially beneficial to small business owners looking to incentivize new employees but not sure which route to take. I enjoyed how you outlined the tax advantages that the employer will enjoy. It’s like a win win. What I’m curious about are the hurdles employers will face when adopting these plans. It would’ve been great to see a few here.

Otherwise a great blog.

Hi Taylor,

I found your blog very interesting because I had very limited knowledge on retirement plans. I was amazed at some of the statistics even though I am very aware of the challenges that employers have been facing these past few years. The statistic from Fidelity was extremely interesting that only 13% of workers would accept a job with no employer match with their 401(k). I liked how you laid out the different choices that employers had and provided the advantages of each. In my opinion, the simplified employee pension is a good option. An important point you make in your action steps is that employers can receive a tax credit on half of these expenditures. I think it may have been helpful to mention places or websites that an employer can turn to if they decide to implement one of these plans. A small business might be intimidated by all this information and not know what to do or where to go with this information. But overall, I found this blog very structured, informative, and interesting. Great work.