Introduction : The Utility of Fiscal Policy

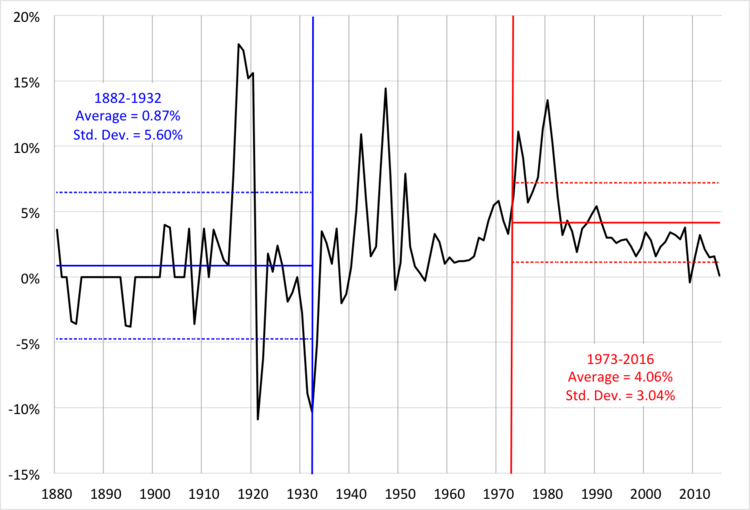

As I touched upon in the last blog, the United States government utilizes three main branches of policy to promote a stable and flourishing economy: monetary policy, fiscal policy, and international trade agreements. Most economists agree that in the long run, or the broader trend that runs independent of short term cycles, economic growth is only fostered through an increase in productivity or in the factors of production (more labor, more resources, or more capital). However, in the short term, the economy frequently undergoes periods of expansion and contraction consistent with the general model for the business cycle.

Image Source: https://corporatefinanceinstitute.com/resources/economics/business-cycle/

For instance, a period of short-term economic growth could increase the demand for goods and services as household income increases. Eventually, suppliers react to this demand shift by raising prices to maximize profits, which then slows demand and firms begin to lose profits as relative income levels for households decreases. Eventually, downward pressures on prices should revitalize demand and bring the economy into a period of temporary expansion, leading the cycle to repeat itself all over again. While this explanation is overly simplified and fails to account for the complexities and intricacies of economic cycles in the real domestic economy, it provides a basic understanding of the utility of fiscal policy. While the cyclical nature of the economy is an unavoidable manifestation of constantly changing factors that adjust supply and demand, there are ways to decrease to the relative magnitude of these cycles in order to avoid the negative externalities on society that result from large-scale displacements from equilibrium. For instance, an expansionary period in the cycle may lead to unchecked inflation which reduces the purchasing power of citizens and disproportionately effects those which have money saved rather than in assets, leading the value of their wealth to diminish. On the other hand, a recessionary period can mean job layoffs and a much higher rate of national unemployment as firms reduce their operations in response to the shifting demand. Hence, fiscal policy aims to use the Constitutional authority vested in Congress to adjust government spending so that it keeps the economy from undergoing large peaks and troughs in the cycle, and thus avoiding high inflation or unemployment.

How is Fiscal Policy Different From Monetary Policy?

Although Fiscal Policy intends to achieve the same general goal as Monetary Policy, namely intervention into the economy to both prevent and respond to deviations from equilibrium, it is carried out through entirely different means. Fiscal Policy involves the efforts of duly elected officials in Congress that represent the interests of their constituents. While many have a background in economics, they are not necessarily trained experts in economic policy and have a more vested interest in crafting policy that aligns with loyalties to political party, constituent beliefs, and personal beliefs.

Image Source: https://www.science.org/doi/10.1126/science.349.6247.486-a

Monetary Policy, on the other hand, is carried out by Federal Reserve technocrats who almost uniformly carry doctorate-level degrees in economics and are experts in public policy. Members of the Federal Reserve are theoretically not under the influence of any electoral or political pressures and hence maintain a uniform focus on maximizing efficiency when making decisions. Monetary Policy also differs substantially in swiftness, as central banks can adjust short term interest rates overnight while enacting Fiscal Policy requires the elongated Congressional process of drafting a bill that is then debating by committees and eventually brought before the entire Congress for a vote. In addition to different means of being carried out, Fiscal and Monetary Policy are substantively different. While Monetary Policy involves expanding or contracting the reserves available for banks to lend, Fiscal policy involves expanding or contracting government spending. For instance, the CARES Act that was passed in the aftermath of the Covid Pandemic was a definitive example of the government using Fiscal Policy to reduce the scope of recession. The $2.2 trillion stimulus package supplied money to households as well as businesses, demonstrating attempts to bring both the supply and demand-side of the economy toward equilibrium.

Has Fiscal Policy Been Effective?

Just as with monetary policy, fiscal policy seems to be a flawless mechanism in theory to minimize the destabilizing effects of short term dips and leaps in the economy. When the economy is slow and unemployment is high, increasing government spending can improve infrastructure, boost consumer spending, and even increase business productivity. Then when the economy is in a “bubble” and prices outpace real economic performance, decreasing government spending and increasing tax revenues will slow the flow of money through the economy, decreasing inflation. However, it is rarely ever this simple in the real economy. Here are a few distinct historical and contemporary examples where the merits and efficacy of fiscal policy have heavily been debated by economists and politicians:

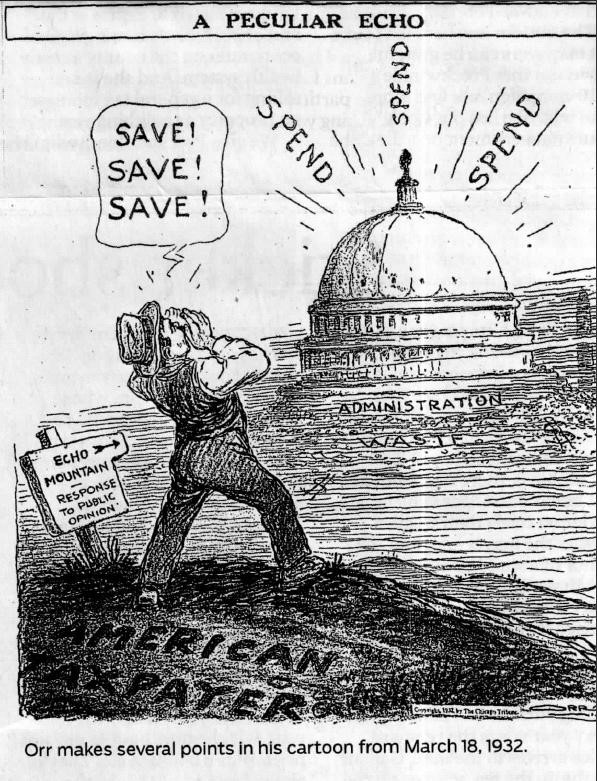

Example 1 – New Deal Programs

Just as the Depression was the most significant economic and financial crisis in American History, the policies implemented in its aftermath by President Franklin Delano Roosevelt were similarly revolutionary in how they framed the new relationship between the government and the economy, and set the stage for future fiscal policy. As Price Fishback notes in the Journal of Economic Literature, “During the 1930s, the federal government for the first time took responsibility for solving general problems with unemployment and poverty, established the modern farm grant and loan programs, subsidized the housing market, banks, railroads, and other industries with low-interest and/or guaranteed loans, and took ownership stakes in banks” (Fishback). These programs were aimed at creating jobs to lower the unemployment rate and break the deflationary spiral while improving stability in the financial system to prevent future systemic bank failures. And while the United States did eventually come out of the Depression, some scholars and economists question the efficacy of the New Deal Programs in achieving this effect versus the manufacturing boom precipitated by WW2. For instance, George Selgin of the CATO Institute argues that while sustained deflation is a very undesirable phenomenon that especially hurts those with outstanding debts, it may be a necessary occurrence for consumer spending to eventually revamp and put upward pressure on production. He notes that, “so long as spending itself stayed depressed, policies that prevented prices from falling only tended to make matters worse” (Selgin). Others have also pointed out the political motivations integral to Roosevelt’s New Deal Policies as “more funds per capita were distributed in areas that were more likely to swing toward voting for Roosevelt and where high voter turnout suggested strong political interest” (Fishback).

Image Source: https://blogs.baylor.edu/greatdepression/documents-page-1/

Example 2 – Economic Stimulus Act of 2008

The 2008 global economic and financial crisis, often coined as “The Great Recession” for being the greatest economic downturn since the 1929 Great Depression, resulted in extensive fiscal policy efforts from the United States government. As the asset bubble in the housing market collapsed, years of financial engineering by investment banks and poor risk assessment from credit agencies turned what could have been a controlled crisis into a catastrophe. With the hopes of inventing a higher-yield investment, banks began to securitize mortgages into bonds and other financial derivatives that were packaged and sold to investors or other banks. A disproportionate number of these securities contained mortgages sold to the riskiest category of homeowners, also known as “subprime”. These types of securities were particularly advantageous since they often produced higher interest rates with respect to other mortgages. As few financial analysts actual performed real risk assessments on the mortgage assets they were holding, many did not realize how much money they stood to lose if the housing market went the least bit sour. Thus, when the housing market did go sour, many banks lost a lot of money or outright failed, like Lehman Brothers, and brought down the entire U.S economy with them. The fiscal response of the United States government to this crisis remains highly controversial to this day and certainly halted further fiscal stimulus in its aftermath with “repeated criticism of the bank bailouts and growing concerns about the national debt” (U.S Bureau of Labor Statistics). While most supported the government policies that “provided large temporary tax cuts to most consumers” in order to boost consumer demand and spending, the direct payments from the government to investment banks was highly contentious (Tax Policy Center). Although some may argue that it was necessary to support the stability of the financial system and ensure liquidity, others see it as rewarding the same bank’s whose greed and carelessness for purchasing risky investments brought the entire economy into the crisis in the first place. Many see the government’s response in 2008 as proof that stimulus is designed to simply enrich large corporate interests and financial institutions rather than American workers who repeatedly are tasked with dealing with their mistakes.

Image Source: https://www.goingconcern.com/tags/lehman-brothers/

Example 3 – COVID Stimulus and CARES Act

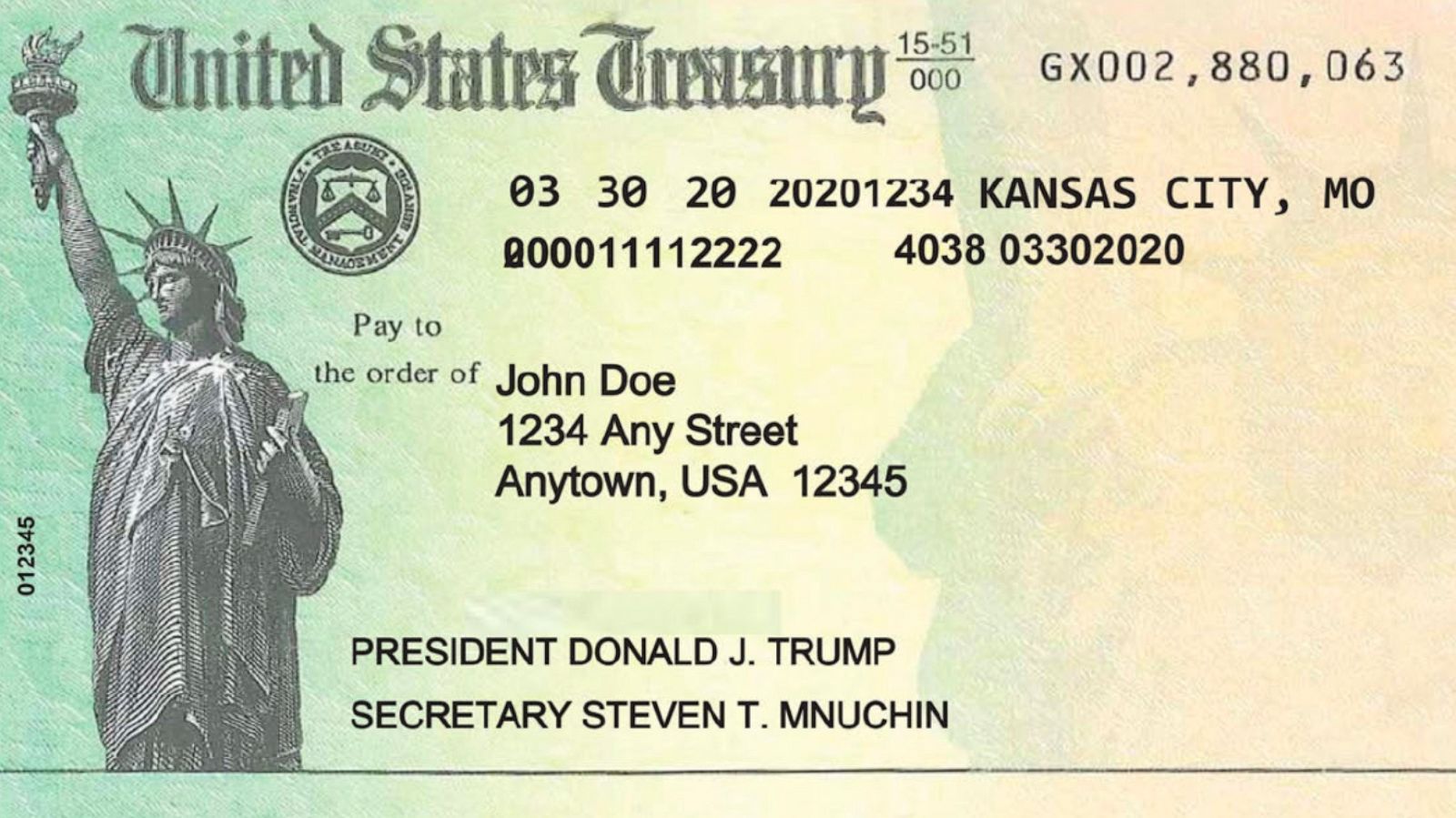

While the fiscal response of the Federal Government in 2008 was unparalleled in its celerity and magnitude, it pales in comparison to the efforts taken to revive the domestic economy following the lockdowns initiated in response to the COVID pandemic. The $2.2 trillion stimulus bill passed by Congress in March 2020 “included direct benefits to furloughed workers, families with children, small businesses, independent contractors and gig workers, large corporations, and the health care system” (Investopedia). While many credit this massive fiscal stimulus as helping keep unemployment down as much as possible while public health restrictions kept people from working, many note its inefficiency in delivering help from those in need. A study conducted by the Brookings Institute to investigate the timeliness of benefits reaching marginalized groups found that “roughly half of those households who stood to benefit from these two major federal relief initiatives were left waiting for them even as unemployment was spiking” (Brookings). Moreover, many cite the excessive fiscal spending as a contributing factor to the inflationary struggles that have plagued our economy by creating a disconnect between supply and demand. While the stimulus was successful in increasing the money supply and disposable income for American consumers to spend on goods and services, it did not address the underlying problems on the supply side that still needed to be fixed as firms struggled to revamp productivity. Thus, the excess of demand in light of limited supply is seen by many economists as the principal reason that inflation has reached above double digits in terms of year over year price increases.

Image Source: https://abcnews.go.com/Politics/inside-donald-trumps-stimulus-checks/story?id=77534116

Works Cited

Fishback, Price. “How Successful Was the New Deal? the Microeconomic Impact of New Deal Spending and Lending Policies in the 1930s.” Journal of Economic Literature, vol. 55, no. 4, 2017, pp. 1435–1485., https://doi.org/10.1257/jel.20161054.

Cato.org, https://www.cato.org/blog/new-deal-recovery-part-3-fiscal-stimulus-myth.

“The Great Recession: In What Ways Did Policymakers Succeed and Fail? : Monthly Labor Review.” U.S. Bureau of Labor Statistics, U.S. Bureau of Labor Statistics, https://www.bls.gov/opub/mlr/2019/book-review/the-great-recession.htm.

“What Did the 2008–10 Tax Stimulus Acts Do?” Tax Policy Center, https://www.taxpolicycenter.org/briefing-book/what-did-2008-10-tax-stimulus-acts-do.

Team, The Investopedia. “What Is The Cares Act?” Investopedia, Investopedia, 5 Sept. 2022, https://www.investopedia.com/coronavirus-aid-relief-and-economic-security-cares-act-4800707.

/cdn.vox-cdn.com/uploads/chorus_image/image/66668240/GettyImages_1209192403.0.jpg)