Economics in Society: An Introduction

The nature of economics is often seen as obscure to the public due its common portrayal in the media as a complex, technical, and mathematical craft whose understanding is limited to handful of bureaucrats and technocrats with advanced degrees in the subject. In reality, economics is simply the nature of human decision making and makes sense of how we allocate our resources to satisfy both our needs and desires. The fundamental principles of economics drive what people buy, what jobs they find, how they plan for the future, and ultimate whether a nation cultivates a relatively high or low standard of living. Regardless of race, gender, socioeconomic class, or political ideology, the state of the economy affects everyone (although it can affect each demographic differently; something surely to be touched on in this and future blogs). Hence, it is no surprise that polling data consistently shows that concern regarding the economy is the principal issue for voters in elections. For instance, an October survey by Pew Research ahead of the 2022 midterm elections found that, across both parties , “about eight-in-ten registered voters (79%) say the economy is very important when making their decision about who to vote for in the 2022 congressional elections” (Schaeffer, Green). With data from the World bank citing annual GDP of the United States at $20.89 trillion in 2022, the United States has by far the largest economy in the world. So what tools does the political establishment use to ensure the stability and strength of such as vast and diverse economy as ours? It turns out, there are many different methods for political officials, economists, and bureaucrats to augment the national economy; however most can be categorized within monetary policy, fiscal policy, or trade policy. For this first blog I want to focus on monetary policy and investigate the question: To what extent has monetary policy been effective in fostering economic goals?

(Source: https://www.pewresearch.org/fact-tank/2022/11/03/key-facts-about-u-s-voter-priorities-ahead-of-the-2022-midterm-elections/ )

Economic Theory: An Introduction

Before delving into the specific branch of economic policy, it would be helpful to give a brief background on economic theory. The understanding of modern economic theory, also known as classical economics, began with Adam Smith’s writing of The Wealth of Nations. Smith, an economist and philosopher, posited the idea of the “invisible hand” of the free market allocating resources more efficiently than a central government could. However, most modern economies, while being structured around a free-market, also contain apparatuses that reflect a belief in the necessity of government intervention to periodically restore the economy to equilibrium. While some economists are more opposed to intervention than others, most recognize its necessity under certain circumstances. Monetary policy is an ubiquitously used form of intervention by economies around the world to achieve this goal.

(Source: https://www.kobo.com/us/en/ebook/the-wealth-of-nations-illustrated-2 )

Monetary Policy in America and the Federal Reserve

Monetary policy, in its most basic sense, is the controlling of the money supply and interest rates by a nation’s central bank system. In the United States, monetary policy is conducted by the Federal Reserve System. This system was established in 1913 by the Federal Reserve Act which was passed in Congress and approved by president Woodrow Wilson. While a national banking system was somewhat present in the era before the Federal Reserve, it consisted of a loose structure of commercial banks that issued currency notes tied to the quantity of government bonds stored by the banks (Wheelock). However, since the amount of currency issued and stored in reserves did not adjust to fluctuations in supply and demand, or was inelastic, there was a major liquidity problem “when an unforeseen event or news caused bank customers to worry about the safety of their deposits and ‘run’ to their banks to withdraw cash” (Wheelock). Hence the establishment of a singular Federal Reserve bank was predicated on the ability of a centralized authority to regulate the money supply through the U.S banking system in a way that promotes the sustained stability of the U.S economy. While the concept of “monetary policy” wasn’t officially mentioned in the Federal Reserve’s initial establishment, it did contain certain responsibilities that eventually morphed into the modern definition of “monetary policy” as macroeconomic objectives became of greater importance. For instance, the Fed initially required banks to keep a quantity of gold reserves proportional to lending and liabilities, thus restricting the money supply and putting a cap on inflation. Over time, the Fed began to adjust the discount rate, the rate at which money is lent to to other banks, and sell government securities as tools to either increase or decrease the liquidity and hence stimulate or tighten the economy in response to indicators of inflation and unemployment. While this may sound simple and uncontroversial in theory, the actual effects of Federal Reserve Policy are complex and highly controversial. In light of the Federal Reserve’s significance in utilizing monetary policy to achieve the main macroeconomic objects of the U.S economy (low inflation, low unemployment, sustained growth), I want to highlight two main areas of controversy that pit supporters of the Fed against its critics.

/cdn.vox-cdn.com/uploads/chorus_image/image/66668240/GettyImages_1209192403.0.jpg)

(Source: https://www.vox.com/future-perfect/2020/4/17/21220919/fed-federal-reserve-stimulus-main-street-lending-program )

Controversy #1 : Removal of the Gold Standard

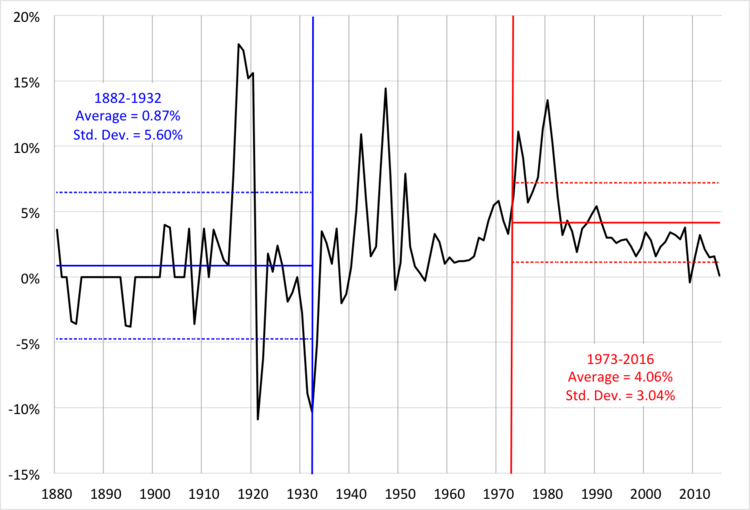

Long before the Federal Reserve, gold was not just seen as a commodity but as a currency that tied its value to the notes issued by national banks, and was exchangeable for dollars at virtually any bank for any customer. Then, In 1933, President Roosevelt removed the ability for consumers to convert their dollars to gold and actually required gold coins and certificates to be returned for money. Now, what was the justification for such a reversal of the status quo in the American banking system? The answer lies in the emergence of Keynesian economic theory, or the principles and philosophies attributed to English economist John Maynard Keynes. A critic of entirely free markets, Keynes believed that the general inelasticity (unresponsiveness in price) of labor and supplies would keep markets form returning naturally to equilibrium during an economic downturn. Hence, government intervention was necessary to keep the economy going during a severe downturn or vicious cycles of deflation and unemployment would ensue. Hence, as a supporter of Keynesian theory, Roosevelt believed that eliminating the Gold Standard could help end the Depression by increasing the amount of gold that banks had in reserves and thereby their ability to inflate the money supply. And while America did eventually get out of the Depression and the economy returned to normal, economists still debate the extent to which Roosevelts policies were effective and whether ending the Gold Standard was a good or bad idea. Many economists with a more Keynesian tilt, favoring more intervention, champion the ending of the Gold Standard and consider it a horrible idea that led to the pre-Fed banking crises and even precipitated the Great Depression. Such theorists of this camp note that the restrictions which required banks to keep a certain value of gold in reserves “shrank the quantity of money available worldwide, and its price level, adding to the burden of real debt, and prompting defaults and bank failures virtually around the world” (Money and Banking). Rather than being a source of stability, these economists cite the increased deviation of GNP and inflation levels before the gold standard, insinuating that its removal has led to less severe recessions and a more consistent business cycle (see chart below). Those with a more classical economic tilt view the complete removal of the gold standard as an irresponsible act giving the Federal Reserve unchecked authority to create new money, thereby threatening the value of the dollar owned by the consumer. They note that the Gold Standard “prevents inflation as governments and banks are unable to manipulate the money supply” and “stabilizes prices and foreign exchange rates” (Lioudis).

(Source: https://www.moneyandbanking.com/commentary/2016/12/14/why-a-gold-standard-is-a-very-bad-idea )

Controversy #2 : Implementation of Quantitative Easing

With the removal of the gold standard and increased flexibility of the Federal Reserve to adjust the discount rate, reserve requirements, and asset composition of regional banks, the Federal Reserve became increasingly involved in the aftermath of crises in order to restore the economy to equilibrium, typically from levels of unusually high unemployment. One such example is in the aftermath of the 2008 Recession, where the asset bubble caused by subprime mortgage lending led numerous investment banks to default and disrupt the entirely U.S and global economy. To do so, the Federal Reserve first used the conventional method of lowering short term interest rates to increase lending to smaller banks to trickle down to businesses and households and in turn stimulate the economy. However, once interest rates reached the “zero” mark and the unemployment rate was still hovering around double digits, it seemed as though the Fed had reached a limit as to how much they could do to stimulate the economy. However, the ambition of Federal Reserve Chairman Ben Bernanke led the bank to pursue a policy that had only been used once before, in the short time after crisis, and that is the policy that is now referred to as quantitative easing. In a process that challenges the conventional wisdom that “money doesn’t grow on trees”, the Federal Reserve buys securities from other commercial banks, such as government bonds, with newly synthesized “digital currency” that would then magically appear into the reserve accounts of these banks. Supporters of this policy champion its effectiveness as a policy of last resort when conventional methods, lowering interest rates, have been exhausted in their full effect and still yield less than ideal macroeconomic results. Quantitative easing may “increase the money supply and provide markets with liquidity” as “expand the balance sheet” of the central bank and their ability to lend to consumers (The Street). Those that criticize it rightly point out the immense amount of power that it gives a single organization over the U.S economy and that it discretely lessens the value of the American dollar without consumers even realizing. Others question its effectiveness if the “banks choose to hold and not lend their extra reserves” and instead use the money to invest in riskier assets and financial derivatives which could “lead to asset bubbles and currency devaluation” (The Street).

(Source: https://www.youtube.com/watch?v=EG-0dAN4q7A )

Works Cited:

Wheelock, d C. “Overview: The History of the Federal Reserve.” Federal Reserve History, https://www.federalreservehistory.org/essays/federal-reserve-history.

What Is Quantitative Easing (QE)? How Does It Affect the … – Thestreet. https://www.thestreet.com/dictionary/q/quantitative-easing.

Lioudis, Nick. “What Is the Gold Standard? Advantages, Alternatives, and History.” Investopedia, Investopedia, 22 Sept. 2022, https://www.investopedia.com/ask/answers/09/gold-standard.asp.

Schoenholtz, Steve Cecchetti and Kim. “Why a Gold Standard Is a Very Bad Idea.” Money, Banking and Financial Markets, Money, Banking and Financial Markets, 6 Jan. 2017, https://www.moneyandbanking.com/commentary/2016/12/14/why-a-gold-standard-is-a-very-bad-idea.

Schaeffer, Katherine, and Ted Van Green. “Key Facts about U.S. Voter Priorities Ahead of the 2022 Midterm Elections.” Pew Research Center, Pew Research Center, 3 Nov. 2022, https://www.pewresearch.org/fact-tank/2022/11/03/key-facts-about-u-s-voter-priorities-ahead-of-the-2022-midterm-elections/.