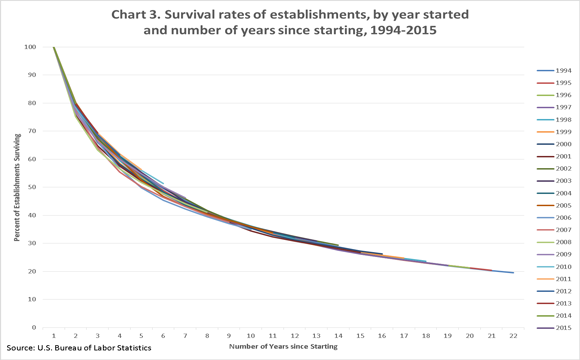

Starting a business can be born from a lifelong dream or a spur of the moment idea. There’s a beauty with that contrast. Regardless of what idea drives that business’s creation, statistics show that it’s hard to maintain financial solvency in the first couple years.  [1] Not much has remained a constant since 1994 other than survival rates of new businesses. It is not all hopeless though! There is a significant tool that entrepreneurs can use to help mitigate some financial load in a business’s early years and beyond. Ironically, this tool is under the radar and most people only think of it one day a year, usually when it’s too late to adequately prepare. (Hint: April 15th is on a Wednesday this year).

[1] Not much has remained a constant since 1994 other than survival rates of new businesses. It is not all hopeless though! There is a significant tool that entrepreneurs can use to help mitigate some financial load in a business’s early years and beyond. Ironically, this tool is under the radar and most people only think of it one day a year, usually when it’s too late to adequately prepare. (Hint: April 15th is on a Wednesday this year).

Under federal law, all businesses must file an annual tax return. Partnerships file an “informational return,” but the annual filing principle remains. Generally, these returns are filed so that businesses pay a tax to the government on income earned or received during the year. Think of income as all the money that comes into a business – not the profit a business may or may not make in a given year. The Internal Revenue Service (“IRS”), however, allows businesses to deduct expenses from its taxable income. Deductions are a powerful asset for a business in reducing its tax liability.

**Of note, states are free to pass their own unique tax statutes. For purposes of this post, I will be examining the basic federal tax system while providing state-specific examples for Pennsylvania. Be sure to check the tax statutes in your own state first!**

As alluded to earlier, new businesses rarely turn a profit in the first couple years of operation. This lack of profit, however, does not have to be all negative. Tax considerations can help offset some of this financial burden. If your business structure allows for pass-through taxation, these initial losses for your business can be used to offset personal income. By doing so, you can pay less in annual income taxes than you would have otherwise. Some common pass-through entities include sole proprietorships, partnerships, LLC’s, and “S” corporations to name a few.

Alternatively, if your business has turned a profit, or even if you simply wish to increase the amount of losses being passed through, all businesses should consider what it can and cannot “write-off.” The term “write-off” can be used loosely to explain something that reduces taxable income. Accordingly, deductions, credits, and expenses overall may be referred to as “write-offs.”

Because a business can deduct its expenses from taxable income, the next logical question should be “well, are there restrictions on what I can deduct?” The bad news is absolutely! Remember, the government is not going to let you off the hook completely for your tax bill – it still wants its share of the pie. The good news is deductible expenses are fairly straight forward. “To be deductible, a business expense must be both ordinary and necessary. An ordinary expense is one that is common and accepted in your trade or business. A necessary expense is one that is helpful and appropriate for your trade or business.” [2] (emphasis added)

Because these deductible expenses are highly contingent on the operative trade or business, it would be silly to attempt to compile a finite list of what is and is not deductible for businesses across the board. There are, however, two relatively universal available deductions for early stage entrepreneurs.

Common Early-Stage Deductibles

First, if you use part of your home for business purposes, you may be able to deduct expenses for the business use of your home. This may include a mortgage interest, insurance, utilities, repairs, and depreciation. For more information, check out the IRS’s reference page for home office deductions here.

Second, if you partially use your car for business purposes, you can deduct those expenses. Any deducted expenses must be in relation to a business purpose; however, you do not need to own separate personal and business vehicles to make this distinction. If you use your car for both business and personal purposes, you can divide your expenses based on actual business mileage. For more information, check out the IRS’s reference page for travel, entertainment, gift, and car expenses here.

“Recent” updates in the law

Any tax related article cannot be complete without mentioning the Tax Cuts and Jobs Act of 2017, the most sweeping tax legislation since the Tax Reform Act of 1986.[3] The new Act does many things, but mainly it makes small reductions to income tax rates for most individual tax brackets and significantly reduces the income tax rate for corporations.[4] The Pennsylvania Department of Revenue publishes a fantastic break down of both business-related and individual provisions of the Act as well as the details of federal and Pennsylvania treatments. The detailed break down can be found here.

Tax resources, even those outside of a traditional accountant, are abundant if you give enough consideration to looking for them. A small amount of research can end up saving you and your company a potentially large amount of money down the road. Remember, it is never too early to start planning in general, especially for taxes.

[1] https://www.bls.gov/bdm/entrepreneurship/entrepreneurship.htm

[2] https://www.irs.gov/businesses/small-businesses-self-employed/deducting-business-expenses (emphasis added).

[3] https://www.congress.gov/115/bills/hr1/BILLS-115hr1enr.pdf

[4] https://www.smith-howard.com/2018-tax-cuts-jobs-act-overview/