The Fair Labor Standards Act (FLSA) allows employers to pay tipped workers as little as $2.13 per hour in cash wages, given that the employee makes at least the difference ($5.12) in tips to reach the $7.25 federal minimum wage. Click here to read an earlier blog on how to claim tip credit.

This blog focuses on the legal risk in claiming tip credit for employees who have non-tipped duties. “Dual jobs” refer to an employee performing different jobs for a single employer. An example of dual jobs is a hotel employee serving as a maintenance person and a waiter. The employer cannot claim tip credit for the hours spent in the maintenance role.

It gets complicated where an employee is engaged in “dual tasks.” Imagine a server. Servers reset tables, greet customers, and stock supplies. Employees such as servers have sued employers who claim tip credit, arguing that they are entitled to minimum wage for time spent on non-tipped tasks. This blog focuses on: (1) the dual task issue and (2) how to ensure compliance and decrease the risk of lawsuits.

HOW DOES FLSA ADDRESS PERFORMANCE OF DUAL TASKS?

FLSA states that time spent on “related duties” can be counted towards the tip credit. For example, the regulation states that an employer can claim tip credit for a “waitress who spends part of her time cleaning and setting tables […] and occasionally washing dishes.”

This language seems straightforward, yet tipped employees engaged in dual tasks have sued employers for time spent on non-tipped duties.

WHAT IS THE DOL’S INTERPRETATION OF THE REGULATION?

The US Department of Labor (DOL) has provided different interpretations in their 2016 and 2018 Field Operations Handbooks (FOH). The FOH are guidelines — they are not binding law.

2016 FOH & CASE LAW

The 2016 FOH created the 80/20 test: an employer cannot factor non-tipped hours into tip credit if the non-tipped hours exceed 20% of the employee’s total hours. For instance, if a server can show that they spent more than 20% of their hours on setting tables, the employer must pay full legal minimum wage for said time.

The Eighth Circuit ruled that the 80/20 test is a reasonable interpretation of the regulation language because the regulation did not generally approve claiming tip credit for dual tasks. The court reasoned that an employer can claim tip credit for related duties only if it takes up a “part of [the employee’s] time” and is performed “occasionally.” Reread that seemingly straight-forward regulation above.

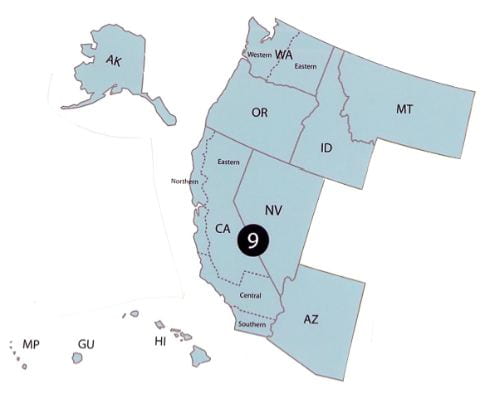

In 2017, the Ninth Circuit held that the DOL’s 80/20 test and the Eighth Circuit failed to consider that the regulation deals with dual “jobs” or “occupations.” The Ninth Circuit stated that there must be a clear dividing line between two types of duties to be engaged in two different occupations. An example of a dividing line is when one set of duties is performed in a distinct part of the workday.

2018 FOH

A year after the Ninth Circuit decision, the DOL published the 2018 FOH, which abolished the 80/20 test. The guideline allows employers to claim tip credit for all related duties performed “contemporaneously” or within a “reasonable time” before or after tipped duties.

SO, IS THERE A TIPPING POINT FOR WHEN AN EMPLOYEE’S TIME SPENT ON NON-TIPPED DUTIES TRIGGERS THE MINIMUM WAGE REQUIREMENT?

The answer is unsettled. Since the 2018 FOH, there have been a few cases addressing dual tasks. However, all courts have disregarded the 2018 FOH abolishing the 80/20 test.

The Northern District of Illinois disregarded the DOL guidance, holding that the 80/20 test is a more reasonable interpretation. Similarly, the District Court for Maryland held that the DOL guidance did not have “any persuasive value.” The Eastern District of Pennsylvania held that the new guidance is “unreasonable and does not reflect the DOL’s fair and considered judgement.”

IF THE ANSWER IS UNSETTLED, HOW DO I ENSURE COMPLIANCE AND DECREASE THE RISK OF LAWSUITS?

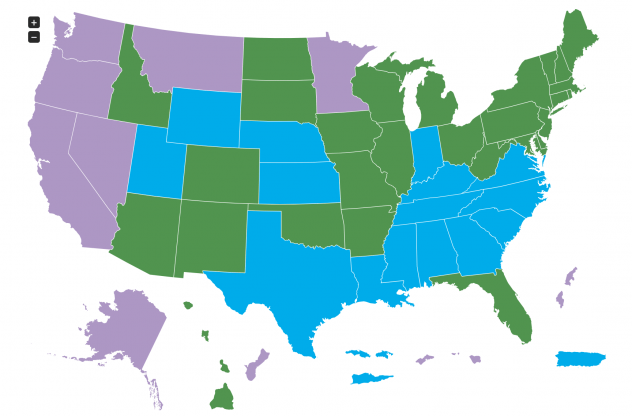

The Ninth Circuit is the only circuit to decide that the 80/20 test is inapplicable. Recent case law trend shows that courts are largely ignoring the 2018 FOH guidance. Employers located in states other than the Ninth Circuit should continue to follow the 80/20 rule (refer to the map below for Ninth Circuit states).

Here are some tips to ensure compliance:

- Make Effective Timesheets.

Tipped employees’ timesheets should require (1) hours per shift, (2) time spent on [X], and (3) total tip amount. Here’s an example:

- Train Employees on Tracking Time.

Employers should train employees on the importance of tracking “time spent on [X].” Employers should also provide employees with a list of categorized duties such as greeting/hosting, stocking supplies, or serving. It is important to allow employees to note down their time between tasks.

- Check Timesheets for Detail.

Employers should check timesheets periodically to ensure that employees are tracking their hours diligently. An employer should have a one-on-one meeting with employees who do not provide enough detail on the “time spent on [X]” section.

- Designate Tasks as Non-Tipped or Tipped.

Whoever controls the payroll system needs to diligently designate certain tasks as non-tipped or tipped tasks. The designation will help employers determine whether a tipped employee should be paid minimum wage for time spent on non-tipped tasks.

FINAL TIP

These tips may seem unnecessary and unnatural. You may wonder if it is reasonable to ask employees to jot down time spent on resetting tables before turning to serving customers. But, these tips are designed to ensure you are compliant with the dual task rules. Even more, these tips mitigate the risk of lawsuits, which can be time-consuming and costly. Some lawsuits even have the potential to cause a business to shut down. Currently, the issue of whether the 80/20 test is in force except for Ninth Circuit states. When facing murky waters, it is always best to err on the side of caution.

SOURCE LIST:

https://www.natlawreview.com/article/2019-wage-hour-developments-year-review-state-updates

https://www.jdsupra.com/legalnews/food-and-beverage-law-update-february-28390/

PHOTO SOURCE LIST:

All other images are created by author