I made a really stupid mistake just before Christmas. I pride myself on knowing enough not to fall into financial traps. And I did exactly that.

I was doom scrolling through social media and came across an ad offering me a too good to be true deal on an electric fireplace/entertainment center. I wanted it to be real. It looked real. So I clicked. It took me to a web site that looked just like Big Lots. But it was BigLotsSale.com. Not Big Lots. I was convinced it was real. I really wanted that fireplace. So I jumped. I put in my info and my credit card and I was off. I received a confirmation email, so I was sure this was for real. A day or two later I received an email confirming the shipping. It was real! It had to be real!

After a few more days. I went back to the shipping email to click the tracking number and find out when my amazing fireplace would arrive. And that’s when I figured it out. The tracking number didn’t lead to anywhere. I started searching the shipping company and discovered it was fake. Crap! I had been duped. A subsequent search on BigLotsSale led me to discover that this is a very common, yet very well done, scam. Reddit helped me find all of the painful information.

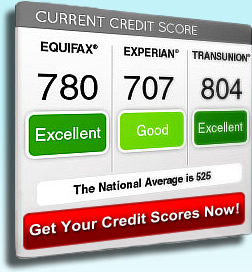

My first action after discovering my mistake was to lock my credit card. Then I looked at the charges on my card and found one that I had not made. I called my credit union and they removed the charge I didn’t make right away. They canceled my card for me and walked me through the process to dispute the charge that I did make on the fake web site. Then came the fun of moving all of my automatically billed things to a different card. Automation is great….until it isn’t. Then I went out to the three credit bureaus (Experian, Equifax, and TransUnion) and put freezes on my account, so the scammers would not be able to open new credit in my name.

I’m actually very lucky. There is no significant damage caused by my error. My only potential loss is the $50 charge I made trying to buy the fireplace. And I may eventually get that back as well. And I learned a very valuable lesson about buying things through an ad on social media. I don’t recommend doing it without first researching the “merchant.” But I also learned how easy it is for people to fall victim to a scam. I’m very educated in this area and still fell for it. How easy would it be for someone who doesn’t focus their life around financial education to make this mistake and have it turn out so much worse?

I’m trying not to beat myself up over this. It’s done. I learned something. Everything turned out ok. This was a very impressive, sophisticated scam. I’m not a financial idiot…just someone who really wanted an amazing deal on something I really desired. Technology is scary. The scammers knew from my online history what would make me jump. And I definitely won’t be making that mistake again. A mistake is only a problem if you don’t learn something from it. And I definitely learned a valuable lesson about shopping from social media ads.

If you have ever fallen for a scam, don’t take it as a personal failure. It’s not. It’s an opportunity to move forward with better knowledge than you had before.

Be careful out there. The internet is a scary place!