Did you know that your financial history has a report card? Your credit report is a detailed snapshot of your financial history, painting a picture of your creditworthiness to potential lenders, landlords, and employers. What your credit report says can significantly impact your financial opportunities and overall well-being.

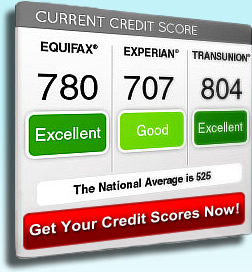

There are three major credit bureaus – Equifax, Experian, and TransUnion – that maintain credit reports for individuals in the United States. These bureaus collect information from various sources, including lenders, credit card companies, and public records, to compile a comprehensive overview of your credit history.

Your credit report contains tons of information, including:

- Personal Information: Your name, Social Security number, birth date, and current and past addresses

- Credit Accounts: Details about your credit card accounts, installment loans, and other credit-related accounts, including balances, payment history, and credit limits

- Public Records: Information on bankruptcies, tax liens, and judgments

- Credit Inquiries: Records of when someone has checked your credit report for lending, employment, or other purposes

By law, you are entitled to a free copy of your credit report from each of the three major credit bureaus once a year. Thanks to a pandemic change that was made permanent, however, you can now get a free copy of your credit report once a week (though that may be overkill for most people). You can access your free reports through AnnualCreditReport.com, the official website authorized by the federal government.

Regularly reviewing your credit reports is important to check for accuracy and identify potential errors or fraudulent activity. If you find any discrepancies, you should contact the respective credit bureau to initiate a dispute. Credit report errors happen more often than anyone would like.

Your credit score is a numerical representation of your credit history. It is derived from the information in your credit report. It typically ranges from 300 to 850, with a higher score indicating better creditworthiness. Lenders and other entities use your credit score to assess your risk as a borrower or tenant. Your credit score itself will not appear on your credit report.

A lot of factors go into the calculation of a credit score. Those with good credit make their payments on time. It’s a good idea to keep your credit utilization to a maximum of 30% of your available credit. Applying for credit multiple times in a short period can lower your credit score. And a longer credit history helps to build a higher credit score, so building strong credit is a bigger challenge for younger people.

Your credit report is basically the report card of your financial habits. You should take a look at it and see how you are doing. If your credit needs work, you should do that sooner rather than later. The worst time to find out there is a problem on your credit report is when you actually need credit. Take a look. It’s worth it.